Sole Trader Income Nz . • start a business • work for yourself • work as a contractor for. one of the first things to do is choose a business structure that's right for you. This is calculated by filing an annual individual income return (ir3). income tax is a tax on the money you earn, including profits from your business as a sole trader. income is income earned from the goods and services you sell (including invoices you've issued but have not received payment. becoming a sole trader. This means you pay tax when you receive an income, so you don’t need. Becoming a sole trader is an easy way to: In new zealand, income tax is applied to individual. sole traders are responsible for preparing, paying and filing their own taxes, as part of running a business.

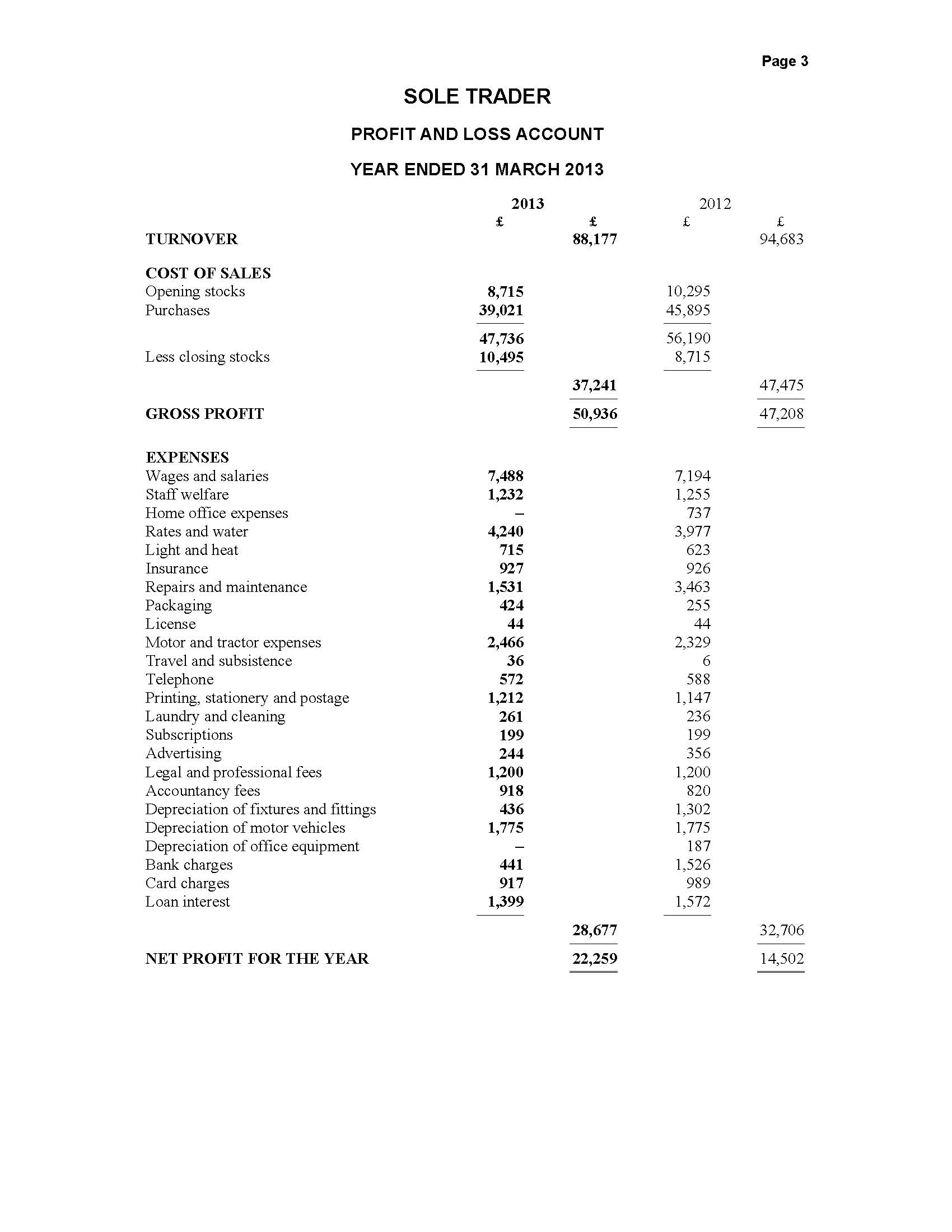

from www.real-price.co.uk

income is income earned from the goods and services you sell (including invoices you've issued but have not received payment. income tax is a tax on the money you earn, including profits from your business as a sole trader. becoming a sole trader. one of the first things to do is choose a business structure that's right for you. • start a business • work for yourself • work as a contractor for. sole traders are responsible for preparing, paying and filing their own taxes, as part of running a business. This is calculated by filing an annual individual income return (ir3). Becoming a sole trader is an easy way to: This means you pay tax when you receive an income, so you don’t need. In new zealand, income tax is applied to individual.

Product detail

Sole Trader Income Nz income is income earned from the goods and services you sell (including invoices you've issued but have not received payment. sole traders are responsible for preparing, paying and filing their own taxes, as part of running a business. This means you pay tax when you receive an income, so you don’t need. Becoming a sole trader is an easy way to: income is income earned from the goods and services you sell (including invoices you've issued but have not received payment. In new zealand, income tax is applied to individual. This is calculated by filing an annual individual income return (ir3). one of the first things to do is choose a business structure that's right for you. • start a business • work for yourself • work as a contractor for. becoming a sole trader. income tax is a tax on the money you earn, including profits from your business as a sole trader.

From www.legendfinancial.co.uk

What Being a Sole Trader Means Their Roles & Liabilities Sole Trader Income Nz • start a business • work for yourself • work as a contractor for. Becoming a sole trader is an easy way to: one of the first things to do is choose a business structure that's right for you. income is income earned from the goods and services you sell (including invoices you've issued but have not received. Sole Trader Income Nz.

From www.businessaccountingbasics.co.uk

A Guide To Sole Trader Accounting Sole Trader Income Nz becoming a sole trader. income tax is a tax on the money you earn, including profits from your business as a sole trader. Becoming a sole trader is an easy way to: In new zealand, income tax is applied to individual. This means you pay tax when you receive an income, so you don’t need. one of. Sole Trader Income Nz.

From www.businessexpert.co.uk

Top Bank Accounts for Sole Traders and SelfEmployed 2024 Sole Trader Income Nz • start a business • work for yourself • work as a contractor for. In new zealand, income tax is applied to individual. This is calculated by filing an annual individual income return (ir3). income tax is a tax on the money you earn, including profits from your business as a sole trader. income is income earned from. Sole Trader Income Nz.

From www.soloapp.nz

Simple Accounting Software For Sole Traders Solo NZ Sole Trader Income Nz Becoming a sole trader is an easy way to: In new zealand, income tax is applied to individual. one of the first things to do is choose a business structure that's right for you. becoming a sole trader. income is income earned from the goods and services you sell (including invoices you've issued but have not received. Sole Trader Income Nz.

From topnotepad.com

New Zealand Sole trader accounting software Sole Trader Income Nz income tax is a tax on the money you earn, including profits from your business as a sole trader. sole traders are responsible for preparing, paying and filing their own taxes, as part of running a business. Becoming a sole trader is an easy way to: This means you pay tax when you receive an income, so you. Sole Trader Income Nz.

From db-excel.com

Sole Trader Bookkeeping Spreadsheet for Bookkeeping Template For Sole Sole Trader Income Nz income is income earned from the goods and services you sell (including invoices you've issued but have not received payment. • start a business • work for yourself • work as a contractor for. In new zealand, income tax is applied to individual. Becoming a sole trader is an easy way to: This is calculated by filing an annual. Sole Trader Income Nz.

From www.youtube.com

Sole Trader in NZ Explained. How to Start a Business in New Zealand Sole Trader Income Nz income is income earned from the goods and services you sell (including invoices you've issued but have not received payment. This is calculated by filing an annual individual income return (ir3). sole traders are responsible for preparing, paying and filing their own taxes, as part of running a business. This means you pay tax when you receive an. Sole Trader Income Nz.

From fabalabse.com

What does a sole trader pay tax on? Leia aqui What do sole proprietors Sole Trader Income Nz Becoming a sole trader is an easy way to: income is income earned from the goods and services you sell (including invoices you've issued but have not received payment. one of the first things to do is choose a business structure that's right for you. This means you pay tax when you receive an income, so you don’t. Sole Trader Income Nz.

From www.ebay.com

Selfemployed sole trader expense and profit tracker Sole Trader Income Nz Becoming a sole trader is an easy way to: income is income earned from the goods and services you sell (including invoices you've issued but have not received payment. • start a business • work for yourself • work as a contractor for. This is calculated by filing an annual individual income return (ir3). This means you pay tax. Sole Trader Income Nz.

From www.real-price.co.uk

Product detail Sole Trader Income Nz becoming a sole trader. Becoming a sole trader is an easy way to: one of the first things to do is choose a business structure that's right for you. sole traders are responsible for preparing, paying and filing their own taxes, as part of running a business. income is income earned from the goods and services. Sole Trader Income Nz.

From okokke.kinsta.cloud

Navigating the Maze A Comprehensive Guide to Calculating Sole Trader Sole Trader Income Nz income tax is a tax on the money you earn, including profits from your business as a sole trader. In new zealand, income tax is applied to individual. becoming a sole trader. Becoming a sole trader is an easy way to: income is income earned from the goods and services you sell (including invoices you've issued but. Sole Trader Income Nz.

From rounded.com.au

Sole Trader Tax Guide Rounded Sole Trader Income Nz This means you pay tax when you receive an income, so you don’t need. In new zealand, income tax is applied to individual. • start a business • work for yourself • work as a contractor for. Becoming a sole trader is an easy way to: sole traders are responsible for preparing, paying and filing their own taxes, as. Sole Trader Income Nz.

From www.billdu.com

Invoice Templates for SelfEmployed & Sole Traders NZ Billdu Sole Trader Income Nz sole traders are responsible for preparing, paying and filing their own taxes, as part of running a business. • start a business • work for yourself • work as a contractor for. income tax is a tax on the money you earn, including profits from your business as a sole trader. one of the first things to. Sole Trader Income Nz.

From www.soloapp.nz

Claim Sole Trader Deductible Expenses NZ Sole Trader Income Nz income tax is a tax on the money you earn, including profits from your business as a sole trader. becoming a sole trader. • start a business • work for yourself • work as a contractor for. This is calculated by filing an annual individual income return (ir3). In new zealand, income tax is applied to individual. . Sole Trader Income Nz.

From accotax.co.uk

What are the sole trader pros and cons? Guide Accotax Sole Trader Income Nz sole traders are responsible for preparing, paying and filing their own taxes, as part of running a business. income is income earned from the goods and services you sell (including invoices you've issued but have not received payment. one of the first things to do is choose a business structure that's right for you. This means you. Sole Trader Income Nz.

From www.youtube.com

Sole trader statement YouTube Sole Trader Income Nz income is income earned from the goods and services you sell (including invoices you've issued but have not received payment. Becoming a sole trader is an easy way to: income tax is a tax on the money you earn, including profits from your business as a sole trader. sole traders are responsible for preparing, paying and filing. Sole Trader Income Nz.

From eventura.com

Making Tax Digital For Tax A Sole Trader's Guide Eventura Sole Trader Income Nz becoming a sole trader. one of the first things to do is choose a business structure that's right for you. This means you pay tax when you receive an income, so you don’t need. In new zealand, income tax is applied to individual. This is calculated by filing an annual individual income return (ir3). • start a business. Sole Trader Income Nz.

From www.parpera.com

Sole Trader Tax Deductions (How to Optimise your Taxes in 2022) Sole Trader Income Nz In new zealand, income tax is applied to individual. income tax is a tax on the money you earn, including profits from your business as a sole trader. • start a business • work for yourself • work as a contractor for. This is calculated by filing an annual individual income return (ir3). income is income earned from. Sole Trader Income Nz.